How Digital Transformation is Reshaping GCC Businesses

By Luca Yazdanpanah

Imagine you are looking to buy a new apartment in Dubai or lease some office space, but you are thousands of miles away? If you are buying property from Al Futtaim, a leading UAE conglomerate, you can do a virtual walk-through ahead of your visit to help inform your decision. As you contemplate your next move, you might turn to your HSBC app on your phone to explore the myriad financing options for your next step.

Both of these actions are a direct result of the rapid technological advancements that have impacted every aspect of human life. Well-established brands – as well as start-ups making their way in the world – have been able to attract new customers and improve efficiency by leveraging technology. Ultimately, this increased adoption of technology in business is known as digital transformation.

Digital transformation, according to McKinsey, helps build a competitive advantage by deploying technology to improve customer experience and lower costs. Moreover, businesses embark on this transformation as a long-term effort to rewire how the company continuously improves and changes. Businesses in every sector have been using technology to cut costs, collect invaluable data, and operate in a more efficient manner.

The six countries of the Gulf Cooperation Council (GCC) – Bahrain, Kuwait, Oman, Saudi Arabia, Qatar, and the United Arab Emirates – have been leaders in digital transformation.

Beyond the buzz word, what does digital transformation really mean?

Essentially digital transformation is where businesses focus on implementing technology into various aspects of their products/services. To pull this off, companies need employees who specialize in technology. Furthermore, there should be sufficient digital literacy skills on an organization level. Having the technological know-how allows companies to embark on their transformations. These plans are centered around analyzing and using data to make the company more efficient and maximize revenue. Overall, data is key in digital transformations and drives the decisions a company makes.

Consumers also benefit from digital transformation. Namely, increased customer satisfaction. Businesses can offer users a more efficient and personal experience through the use of data analytics. In turn, users encounter a better and more tailored experience.

Due to the GCC’s use of technology and strategic initiatives aimed at diversifying economies, digital transformation is very prevalent in the region; however, as PWC points out in a report on the state of GCC digitalization, there are some flaws as well. First of all, there is a lack of organizational vision and leadership. While many businesses recognize the value of technology, there is a lack of long-term vision for businesses’ technological ecosystem (this defeats one of the goals of digital transformation). Companies should “approach this challenge holistically by creating the building blocks for digital transformation.” Essentially, companies must have a long term view of how technology will be used in their organization, and require the right leadership team to do so.

Next, members of the organization must develop strong IT skills, and currently many do not have sufficient expertise to fully utilize the technology that the business has implemented. As a result, the new technology becomes useless if its potential cannot be maximized. Therefore, businesses must also invest in educating employees and consumers, not just the technology itself.

Digital transformation will likely become more widespread and effective in the GCC’s near future. This is indicated by the promising investment into technology and a few big-name examples that prove how beneficial digital transformation can be if done effectively. There are a few key players in the GCC that have been heavily investing into technological development. The United Arab Emirates estimates that it will allocate $23 billion USD by 2024 to Information and Communications Technology (ICT) spending. Furthermore, Qatar is expected to spend around $9 billion USD in a similar timeline.

It is also important to mention that GCC countries have also made significant investments in 5G technology. Such networks will allow higher speeds and increased network capacity. This will help businesses handle more website traffic and allow them to develop technologies and services that use more computing power. Furthermore, by 2024, it is expected that 77% of UAE SMEs will have invested in cloud computing technology. The heavy focus on investment “is a testament to the remarkable progress in digital transformation.” Ultimately as investment into technology becomes more prevalent so will the ability to implement technology, and as a result it is likely we will see even more digital transformations in the region.

There have been a few big-name examples of successful digital transformations in the GCC that have outlined the value in it and serve as examples to other businesses that aspire to embark on the same journey. One such example is the digital transformation of UAE-based conglomerate – Al Futtaim. The mega business adopted cutting-edge technologies and had a user-centric vision. By implementing technology in their business they were able to provide personalized experiences that increased customer loyalty. The Chief Technology Officer stated in an interview, “We wield the power of data to make informed decisions, personalize experiences, and supercharge our performance.”

Al Futtaim used the data they collected to gain new consumer insights and attract new customers. They used groundbreaking augmented and virtual reality technologies to provide their real estate business with a platform for virtual walkthroughs. The core of their vision was to increase customer satisfaction, and through the strategic use of technology, they were able to do so.

Additionally, HSBC in the Middle East has undergone a digital transformation that has yielded very impressive results and has given them a competitive advantage over other banks in the region. After undergoing this transformation, 82% of their clients have rated their experiences as excellent, and onboarding new clients takes a maximum of 3 days – this is significantly less than the maximum of 120 days it could take at some banks. All of this was enabled through technology. HSBC was able to create value and provide new services such as a digital information portal that gives clients access to liquidity management and global market solutions.

Evidence has shown that digital transformation is a valuable way to enhance business performance and customer experience. Through strategic implementation of technology, businesses can lower costs and improve efficacy, thus improving customer retention and satisfaction. While the benefits are clear, there are some obstacles that the GCC must overcome so that digital transformation can become more widespread and successful. It is essential that businesses have a long-term digital plan, and that they do not go through a digital transformation just for the sake of it.

Additionally, analysts say that companies must work on finding the right talent to pull off a transformation and must make sure that it is clear to employees and customers alike how they can use the new technology to their advantage. It is likely that due to the heavy investment spending by countries in the GCC on digitization, that transformations will become more prevalent in the coming years. This coupled with the big-name examples of HSBC and Al Futtaim demonstrates an upcoming shift towards digitization in a wide range of industries in the GCC. Going forward, digital transformations will not be a novelty, they will be essential.

China’s Global Trade Profile and Economic Growth: A Snapshot

By Yunbo Zhou

When China, the world’s largest trading nation, announced a re-opening to the world late last year after its heavy zero-covid lockdowns, many exporters from Argentina to South Korea rejoiced at the news.

China’s multiple lockdowns complicated supply chains, adding pressure to already existing inflation across the world. In addition to its role as a manufacturing engine of the world economy, China is also a major demand engine for the world’s goods. So, when China re-opens, many markets from soybeans to oil to luxury goods will get a jolt

Which countries/regions send the most exports to China?

The below is a top 5 list from 2021

- Taiwan

- South Korea

- Japan

- United States

- Australia

China imported more than $3 trillion of goods in 2021.

| Source | China Imports – billion $ | % of total |

| Taiwan | 251.46 | 8.1 |

| South Korea | 213.45 | 6.9 |

| Japan | 206.15 | 6.6 |

| United States | 180.83 | 5.8 |

| Australia | 162.18 | 5.2 |

Source: IMF Direction Of Trade Statistics; Percentages based on author’s calculations.

As for China, it is also the world’s largest exporter. China exported more than $3.5 trillion worth of goods in 2021. These are the top 5 markets for Chinese goods in 2021.

- United States

- China P.R Hong Kong

- Japan

- South Korea

- Vietnam

| Country/Region | China Exports – billion $ | % of total |

| United States | 577.63 | 16.2 |

| Hong Kong | 351.64 | 9.8 |

| Japan | 165.90 | 4.6 |

| South Korea | 150.55 | 4.2 |

| Vietnam | 137.95 | 3.8 |

Source: IMF Direction of Trade Statistics; percentages based on author’s calculations

As for the year 2022, China ended the year with a 3% GDP growth rate – significantly lower than recent standards over the past three decades. Recently, China’s National People’s Congress (NPC) met in Beijing. On March 5th Li Keqiang, the country’s outgoing prime minister, opened the congress with his annual “work report” and confirmed a GDP growth target of “around 5%” in 2023, lower than many external forecasts.

The 5% growth target for this year should be seen as a base line rather than a goal, according to some analysts who said investors shouldn’t be too discouraged. Zhang Fushen, a senior analyst from Shanghai PD Fortune Asset Management, commented that the biggest takeaway is “no strong stimulus this year,” suggesting that authorities are satisfied with the pace of recovery.

“The growth target may seem underwhelming,” Wei Yao, an economist from Societe Generale SA was quoted as saying in Bloomberg, “but we see it as a strategy of ‘aiming low and overachieve’ by the upcoming new government team, rather than lack of confidence among policymakers” Yao also said that he thought “the government report confirmed a more pragmatic policy stance toward real estate and internet platforms.”

Economic Growth (GDP) for China in 2022 was 3.0%.

Forecasted Economic Growth for China in 2023

| China Forecast Economic Growth | 2023 |

| NPC Congress | ~5% |

| IMF | 5.2% |

| Fitch Ratings | 5% |

| World Bank | 4.3% |

| JP Morgan | 4% |

| Goldman Sachs | 6.5% |

On a systemic level, China’s economy matters deeply to the global economy, but recent reports suggest that China’s recovery will be driven more by domestic consumption and will have a less outsized effect on the global economy.

As the Wall Street Journal reported:

“Early indications suggest the biggest effects of China’s rebound will be felt at home, rather than abroad. Official data, including business surveys, sales and public transit numbers, suggest the strongest growth will come from service industries such as restaurants, bars and travel.”

“That means that while an accelerating China is good news for fragile global growth, especially as the U.S. and Europe are set to slow, the direct effects of its revival will likely be less pronounced elsewhere than in the stimulus-led expansions of the past.”

Still, one can expect the world to be watching China’s growth and trade numbers closely.

New China-to-Europe Rail Routes Amid Ukraine War

By Yichuan Zhang

Amid Russia’s invasion of Ukraine, all eyes have been on the disruption of energy pipelines connecting Russia to Europe via Ukraine. Few have paid much attention to the the Eurasian railway networks disrupted by the war.

Historically, Ukraine has been a key railway conduit into Europe for Russia and China, and its importance has only become more amplified in recent years.

There has been a significant reduction in transit of goods between China and Europe since the start of Russia’s war on Ukraine.

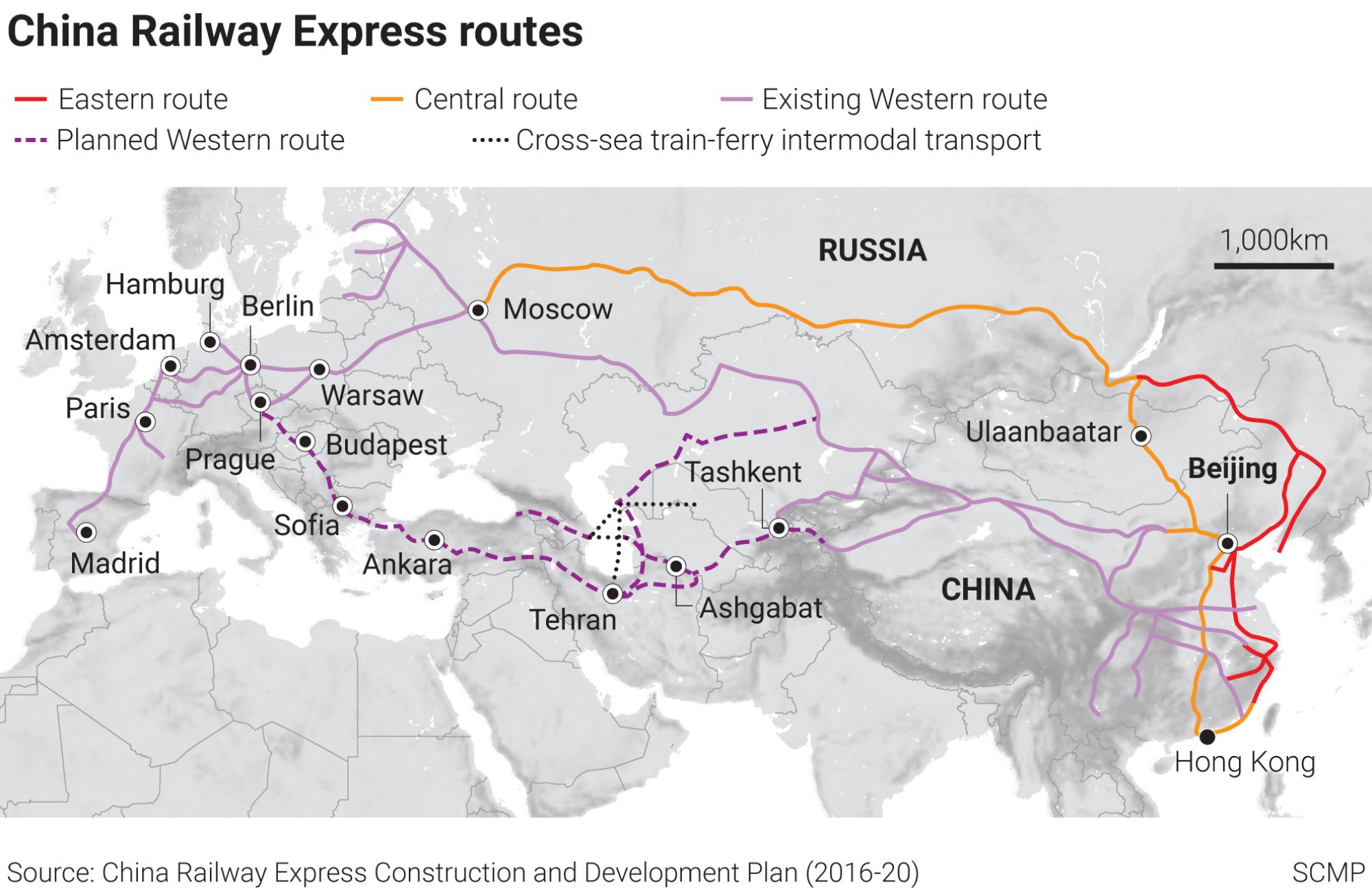

One key route that has been disrupted is known as the China Railway Express route.

As the South China Morning Post reported: “It does not travel along a single route, but a network of railways that span over the two continents- departing from China, passing through Central Asia and finally arriving in western Europe – mirroring the ancient Silk Road. The first train departed in 2011, from Chongqing in southwestern China to the German city Duisburg.”

More from the SCMP article below:

“The eastern, central and Western corridors are the three major routes for the CRE.”

The central route carries goods made in central China, as well as southern coastal provinces such as Guangdong – the manufacturing powerhouse of the country.

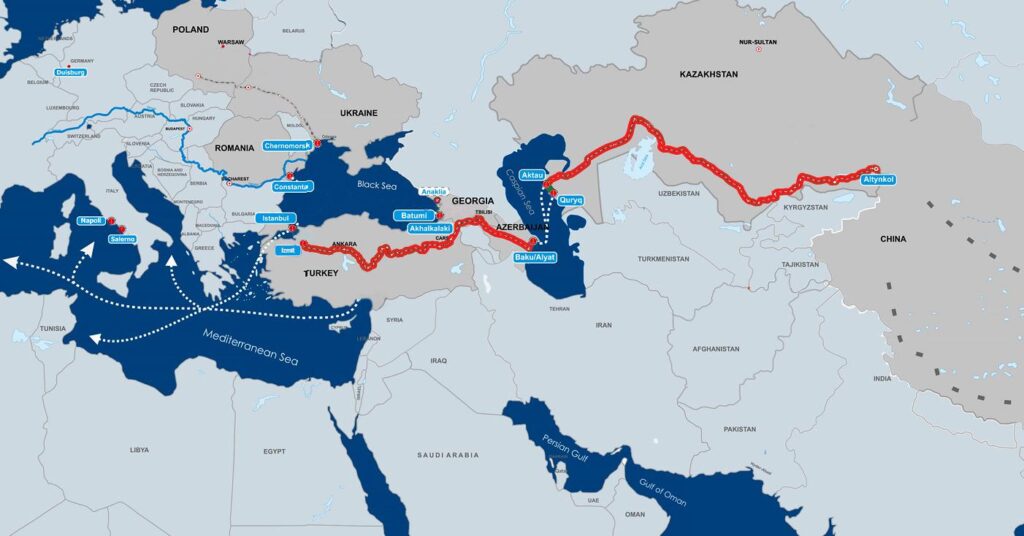

RFERL reports that the Middle Corridor route has emerged as a key alternative to routes that once passed through Russia. (see below)

RFERL writes:

In 2018, Russian President Vladimir Putin ordered the state monopoly Russian Railways to substantially grow container traffic and — prior to its invasion of Ukraine — Moscow said it expected container flows to increase to 3.6 million boxes by 2035.

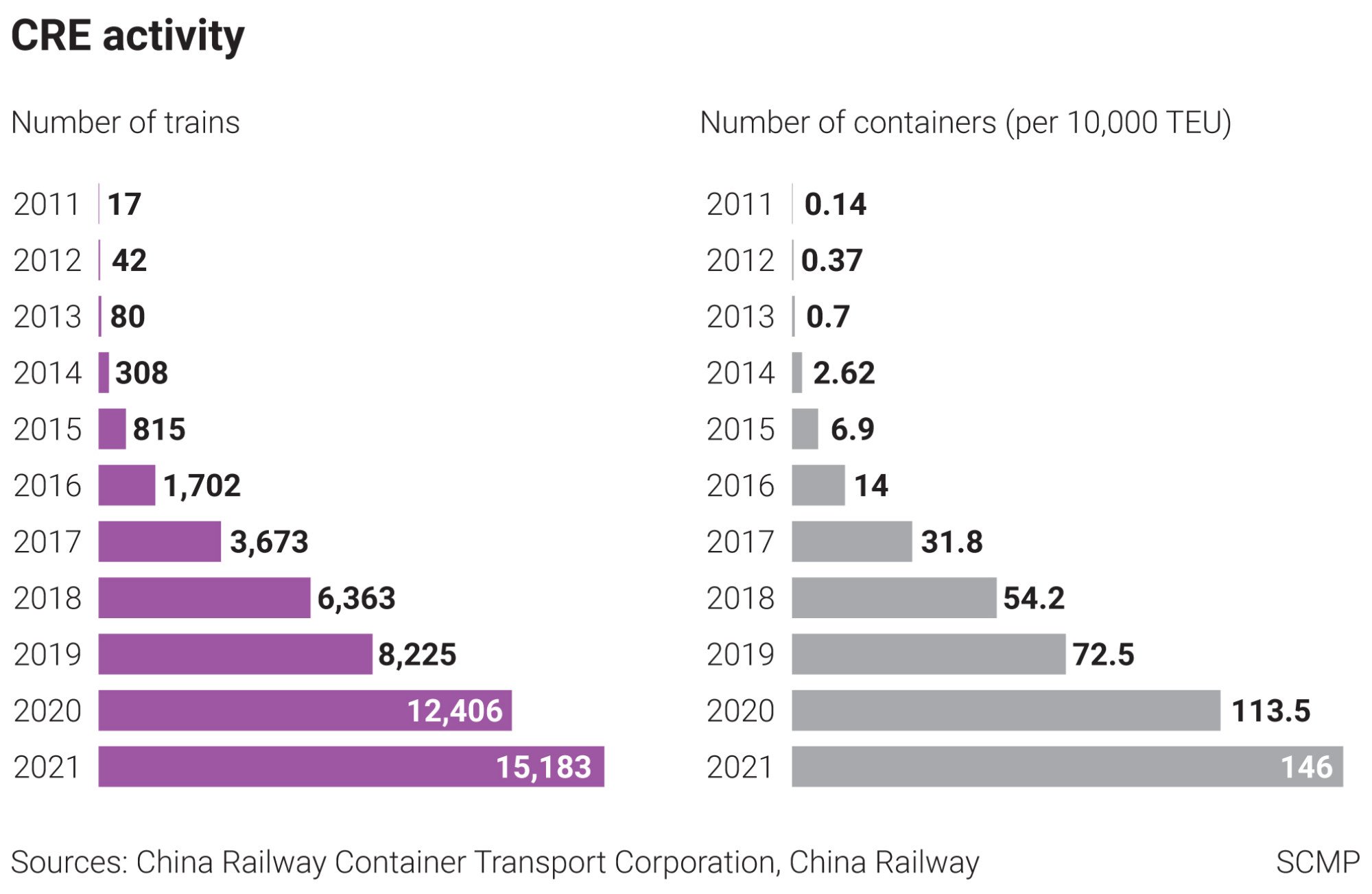

During that span, Beijing worked hard to subsidize, promote, and make profitable those railway lines and the efforts led to a 50 percent increase in cargo transported in 2020, a marked improvement from only a few years previously when trains mostly ran empty on the eastward route back to China.

As transit across Eurasia grew, the northern shipping route through Russia was boasted about as a BRI success story, with Chinese officials saying that it “provided continental supply chain stability.”

But with many large companies and shipping firms unable or unwilling to rely on transport through Russia, a substantial hole has been created and many governments are trying to capitalize by filling it.

Kazakhstan has announced plans to invest more into its ports along the Caspian Sea and its state-run railway operator Kazakhstan Temir Zholy reported that terminals along its western coast have already doubled their shipping volume.

Chinese officials have also moved to simplify transport, with Wang Lingjun, deputy minister of China’s General Administration of Customs, saying on May 25 that Beijing is improving its customs procedures at the Alashankou and Khorgos land ports on its border with Kazakhstan that would lead to increased volumes of goods being sent by rail.While the Middle Corridor is experiencing a boom because of the war in Ukraine, its future viability is far from guaranteed, says Emil Avdaliani, the director of Middle East studies at the Georgian think tank Geocase and a professor at the European University in Tbilisi.

Concerns largely stem from higher costs and more complicated logistics on the southerly route. While critical infrastructure is in place, some of which is the result of BRI projects, the geography of the Middle Corridor — which consists of sea and land lines — is more complex.

Meanwhile, according to RailFreight.com, China now views Budapest, Hungary as a key gateway to Europe. RailFreight.com reports below:

“In China, rail freight operators consider Budapest as one of the rail freight main hubs in Europe. Although traffic is now diverted via Malaszewicze due to the war in Ukraine, it is still consolidated in the Hungarian capital. Luo described the advantages of Budapest as “the operating capacity of the terminals and the available routes leading to the city”. “Especially before the outbreak of the Russian-Ukrainian conflict, there was a direct line from China to Budapest. Starting from Xi’an, China, passing through Kazakhstan, Russia and Ukraine, cargo used to be reloaded to European gauge at the border port of Zahony in Hungary.”

You can watch the full video of the interview here below

It has by now become clear that railways have emerged as an important part of China’s trade with Europe. As the Ukraine war drags on, new networks and routes will grow and build.

Japan’s Trade Snapshot: A Geo-Economic Profile

By Yitong Huang

With globally recognized brands from Toyota to Sony, Japan has emerged as one of the world’s largest exporters. With the third largest economy in the world, it should come as no surprise that Japan is also a major importer of goods and services. For more than four decades, Japan has been a trade powerhouse in the world economy, consistently ranking in the top five of exporters and importers.

An examination of Japan’s trading partners today reveals a robust trading relationship with the two most powerful economies in the world: China and the United States. Nearly one-third of Japan’s exports go to China and the United States (17.17% to China, and 14.25% to the United States). Meanwhile, more than a quarter of Japan’s imports come from both of those states: (18.71% from China and 8.35% from the United States). As is evident, China ranks as Japan’s top trade partner.

Japan’s leading exports to China include machinery, electronic equipment, vehicles, plastics, and medical equipment, among others. Its leading imports from China include electrical equipment, machinery, and apparel, among others. As for the United States, Japan’s top exports include vehicles, electronic equipment, and technical and medical equipment.

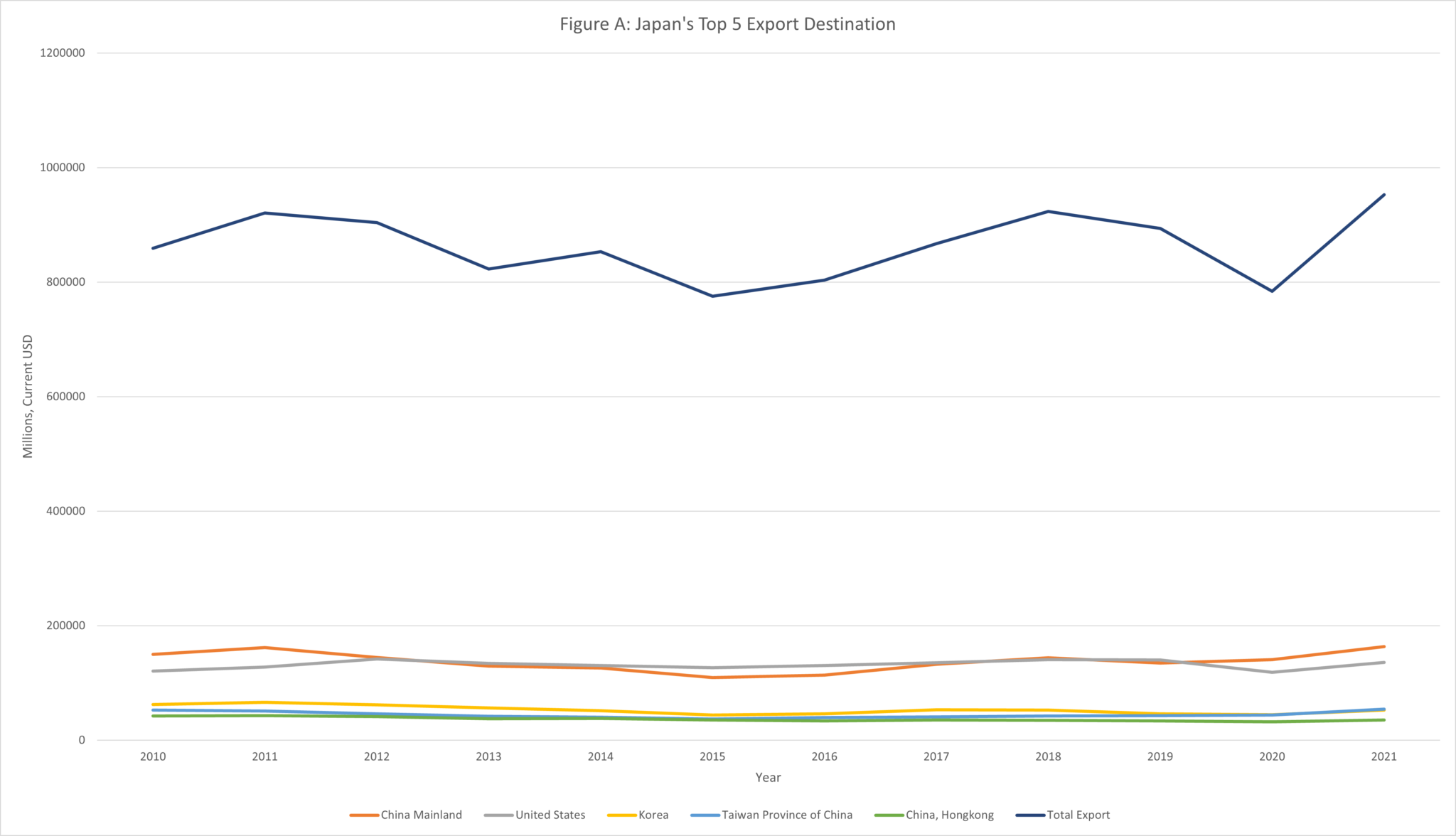

Below are Japan’s Top 5 Export Destinations with US$ Amount (2021)

- China (Mainland) – $163.59 Billion

- United States – $135.77 Billion

- South Korea – $52.50 Billion

- Taiwan – $54.45 Billion

- Hong Kong, China – $35.41 Billion

(AP Style for Country Names)

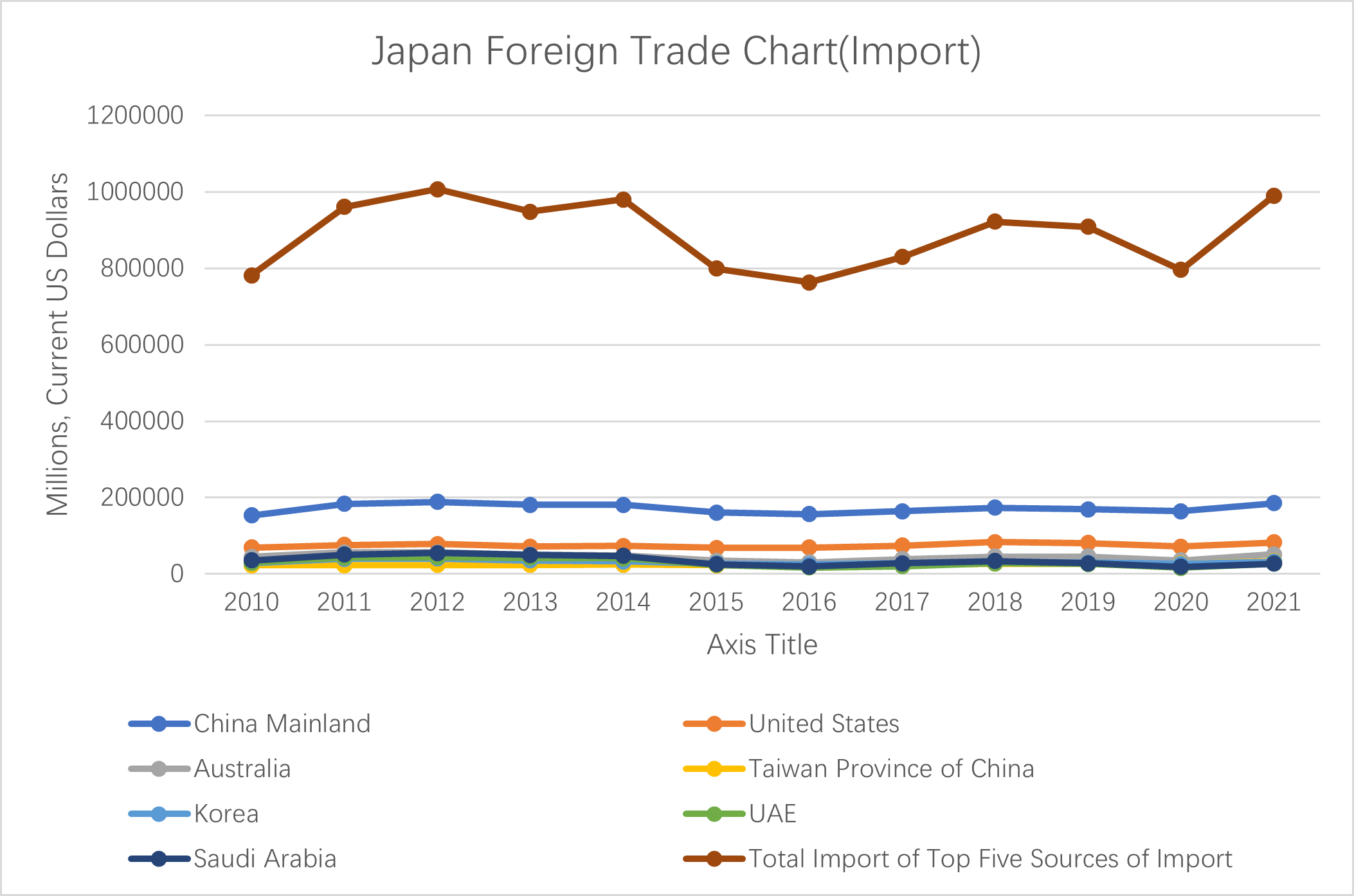

Below are Japan’s Top 5 Import Sources with US$ Amount (2021)

- China Mainland – $185.24 Billion

- United States – $82.66 Billion

- Australia – $51.64 Billion

- Taiwan – $33.57 Billion

- South Korea – $32.00 Billion

(AP Style for Country Names)

Below is a chart that breaks down Japan’s total exports and its top five destinations.

As can be seen in the chart above, Japan’s total exports witnessed a sharp recovery after a Covid-induced dip in 2020. Total exports now approach $1 trillion. Japan is the fourth largest exporter worldwide after China, the United States, and Germany, and just ahead of the United Kingdom. Forecasters see a modest 1.1% rise in Japan’s exports for 2022.

According to Daniel Workman, in an article on the site The World’s Top Exports, the following are: Japan’s top exports worldwide.

Japan’s Top Ten Exports by category (2021)

- Machinery including computers: US$147.1 billion (19.5% of total exports)

- Vehicles: $137.8 billion (18.2%)

- Electrical machinery, equipment: $117.9 billion (15.6%)

- Optical, technical, medical apparatus: $43 billion (5.7%)

- Iron, steel: $34.6 billion (4.6%)

- Plastics, plastic articles: $30.3 billion (4%)

- Organic chemicals: $18.3 billion (2.4%)

- Other chemical goods: $14.6 billion (1.9%)

- Gems, precious metals: $14.3 billion (1.9%)

- Copper: $12.9 billion (1.7%)

Japan’s top 10 exports accounted for roughly three-quarters (75.5%) of the overall value of its global shipments.

In a separate article, Workman notes the following companies as Japan’s top ten export powers

Japan’s Top Ten Export Companies

- Toyota Motor (car/truck makers):

- Sony (consumer electronics):

- Honda Motor (car/truck makers):

- Nissan Motor (car/truck makers):

- Hitachi (electronics):

- JXTG Holdings (oil, gas):

- Panasonic (consumer electronics):

- Mitsubishi Heavy Industries (heavy equipment):

- Toshiba (IT, electronics):

- Nippon Steel (iron, steel):

The above list of Japan’s top exporting companies include several firms with global operations, notably the carmakers. They produce cars worldwide, and export them globally, though those figures are not counted as exports from Japan to the world.

Japan is also a major importer of goods and services, helping fuel global growth. The below chart lays out Japan’s total imports and its main import sources. The UAE and Saudi Arabia enter the list as major providers of petroleum. Japan is highly dependent on oil from the Middle East, accounting for more than 90% of their total demand.

Japan is clearly a major trading nation. Its exports have ranked it in the top five of trading nations since the late 1970s, and its imports help fuel growth in Asia and among major oil and gas exporters in the Middle East. Despite geopolitical tensions with China and South Korea, both countries remain vital trade partners for Japan, with China emerging as Japan’s most important. The U.S still maintains a key place in Japan’s trade profile, and its heavy demand for fossil fuels will ensure that Saudi Arabia and the UAE remain key partners as well.

Germany Military Rearmament To Transform Europe Security Order

By Yichuan Zhang

On February 27th 2022, German Chancellor Olaf Scholz stood before the Bundestag and pledged a 100 billion euro package that would be dedicated to the build up and rearming of the German military, alongside the promise that Germany would finally increase the nation’s defense budget to 2 percent of GDP, reaching the NATO standard. This decision, as a direct result of the political consequences that arose from the Russian invasion of Ukraine, marked a radical break with the policy of pacifism and disarmament that Germany had been pursuing since the end of the Second World War. It is the first of many important geopolitical shifts in Europe in the wake of the war in Ukraine.

How will Germany go about this radical change? Germany does not have a flexible nations budget. As such, its multi-year financial plan disallows radical budget shifts. To accommodate this new spending, Germany’s defense budget would remain flat at around 50 billion euros until 2026, with the 100 billion euro fund being used to pay the difference until the budget could be properly adjusted to NATO standards.

Where will the funds go? It will mostly be spent on purchasing new equipment for the Bunderswher. More specifically, a large chunk of the funds will be allocated to the Air Force, with 41 billion euros allocated to the purchase of CH-47F “Chinook” heavy transport helicopters and F-35 fighters. Additionally, 19 billion euros are set to be taken by the navy towards the construction of new U12 submarines, frigates and corvettes and 17 billion euros will be set aside for the army for the updating of armored combat vehicles. Lastly, 21 billion euros would be spent across all three military branches towards the investment in new communication and encryption technologies.

Contrary to popular belief, German defense spending had actually been rising over the last 6 years. From 2015-2021, the military budget for Germany had grown by 46%, with an average growth of 6-7% percent per year.

Some Key Points on Germany’s Re-Armament

- Germany’s modern day Army is known for its lack of funding, personnel, and equipment. The “Report on the Operational Readiness of the Bundeswehr’s Primary Weapons Systems” suggests that less than 30% of Military assets in Germany are operational. There is also a general lack of basic equipment for the Buneswehr, with the Army running short on materials such as tents and proper winter clothing in 2018.

- “And the Bundeswehr, the army which I have the honour to command, is standing there more or less empty-handed. The options we can offer the government in support of the alliance are extremely limited.”-Lieutenant General Alfons Mais

- The War in Ukraine and the uncertain future prospects of European security had been the main motivator for the German Government to change the current circumstances of the Bundeswehr. Finance Minister Christian Lindner wants to make the Bundeswehr the “most effective army in Europe”.

- The issue with the Bundeswehr is not necessarily a simple issue of funding. Germany still spends about 6 billion dollars more on its army compared to France. However, the French army is about twice as large as the Germany army, has more military hardware at its disposal, while also managing to fit the cost of a sizable navy as well as nuclear deterrence in its budget. This clearly demonstrates that this isn’t a simple issue of funding.

- The agency, “The Federal Office of Bundeswehr Equipment, Information Technology, and In-Service Support”, or the BAAINBw is to blame for this. It is an agency that is responsible for the procurement of all materials for the German Army. It suffers from extreme bureaucratization, and it lacks staff, resulting in very long waiting times for procurement, and inefficient allocation of its budget.

- The 100 billion dollar fund injection is to carry the budget until 2025 or 2026 when the GDP spending can be properly adjusted to 2%. The money is mostly going to be spent on buying things. Such as aircraft, helicopters, and general equipment for the Germany

- Germany’s success in its rearmament efforts lies whether or not it is able to successfully reform the BAAINBw into a more competent agency, otherwise, the issues plaguing the Bundeswehr will not be resolved in the future. The inefficient procurement process and the use of funds is not something that can be solved through the allocation of even more funds.

- “Overall, we have set ourselves up very comfortably in peacetime, and in this context, we have completely over-bureaucratized many things. We feel the effects of that, painfully, now,” said researcher Frank Sauer. This turning point also means “finally rethinking, becoming more flexible and agile — as demanded by the security challenges of the 21st century. This must start in the Defense Ministry.”

Works Cited

(www.dw.com), Deutsche Welle. “Germany’s Bundeswehr ‘Lacks Basic Equipment’ for NATO Mission: DW: 19.02.2018.” DW.COM, www.dw.com/en/germanys-bundeswehr-lacks-basic-equipment-for-nato-mission/a-42638910.

(www.dw.com), Deutsche Welle. “Germany’s Military Upgrade Hampered by Bureaucracy: DW: 07.06.2022.” DW.COM, www.dw.com/en/germanys-military-upgrade-hampered-by-bureaucracy/a-62046032.

(www.dw.com), Deutsche Welle. “How Will the German Military Spend €100 Billion?: DW: 03.06.2022.” DW.COM, www.dw.com/en/how-will-the-german-military-spend-100-billion/a-62020972.

-, George Allison, et al. “Less than a Third of German Military Assets Are Operational Says Report.” UK Defence Journal, 29 June 2018, ukdefencejournal.org.uk/less-third-german-military-assets-operational-says-report/.

“Beware of Potemkin: Germany’s Defense Rethink Risks Reinforcing Old Habits.” War on the Rocks, 15 Apr. 2022, warontherocks.com/2022/04/beware-of-potemkin-germanys-defense-rethink-risks-reinforcing-old-habits/.

Deutschland, RedaktionsNetzwerk. “Reaktion Auf Russischen Krieg: Lindner Will Bundeswehr Zur „Wirksamsten Armee Europas’ Machen.” RND.de, www.rnd.de/politik/reaktion-auf-russischen-krieg-lindner-will-bundeswehr-zur-wirksamsten-armee-europas-machen-OR2OM2P5ILDKD7IZMKNQ77B44A.html.

“Germany Calling: The Bundeswehr, Acquisition and a Broken Narrative.” Royal United Services Institute, 13 Feb. 2019, rusi.org/explore-our-research/publications/commentary/germany-calling-bundeswehr-acquisition-and-broken-narrative/.

Person. “German Army Chief ‘Fed up’ with Neglect of Country’s Military.” Reuters, Thomson Reuters, 24 Feb. 2022, www.reuters.com/world/europe/german-army-chief-fed-up-with-neglect-countrys-military-2022-02-24/

Defense Expenditure of NATO Countries (2014-2021)

“Germany Military Spending/Defense Budget 1960-2022.” MacroTrends,

www.macrotrends.net/countries/DEU/germany/military-spending-defense-budget

Global Inflation: The Top Ten Worst Hit Countries

By Zubin Eimen

When the U.S annualized inflation rate hit 9.1% this June, newspaper headlines screamed “crisis.” No doubt, such inflation numbers pose a serious challenge to U.S President Joe Biden and a continuing challenge to the American consumer who has not seen such price rises in four decades.

The U.S, however, is not alone. Europe is also experiencing similar inflation numbers, as are many countries across the developing and emerging world. In fact, the general increase in the prices of goods and services – the basic definition of inflation – has become a global phenomenon, generating a great deal of uncertainty and instability.

From supply-chain issues in the wake of strong consumer demand, to worker shortages, to financial instabilities from the Russia invasion of Ukraine, a wide range of factors have been pushing prices upward.

For some countries, particularly in the developing world, inflation has hit truly crisis proportions.

Here are the current Top Ten highest inflation rates by nation, with the most up-to-date figures available (measured on an annual basis).

| Country | Inflation Rate |

| Lebanon | 210 % |

| Zimbabwe | 192 % |

| Venezuela | 167% |

| Sudan | 149% |

| Syria | 139 % |

| Turkey | 79 % |

| Argentina | 64 % |

| Suriname | 56 % |

| Sri Lanka | 55 % |

| Iran | 53 % |

https://tradingeconomics.com/country-list/inflation-rate?continent=world

China and the US: Battle of the Digital Superpowers Heats Up

By Kian Akhavan

The advent of the internet has fundamentally reshaped society, the economy and global politics.

Its ubiquity has made the world a smaller place, democratizing knowledge and removing barriers to communication. As an inextricable part of daily life for billions of people, service providers collect and store troves of personal data, from the trivial – like information about an individual’s shopping habits – to the most intimate – like their bank details and social security numbers.

Like any major transnational phenomenon, the internet, and particularly the data stored within it, has created new threats to privacy, security and civic cohesion. As a result, it has become a key feature of the ever-intensifying geopolitical rivalry between the United States and China.

For decades, the United States and its rivals have been conducting cyber espionage and executing cyberattacks on each other. Perhaps most notably, the Chinese government has been accused of conducting (cyber-)espionage against Western countries, particularly the US. One of the most significant such attacks occurred in 2015, when Chinese intelligence agencies gained access to US government security clearance files by hacking into its Office of Personnel Management.

This revealed the personal details of nearly 22 million federal government employees and contractors, such as their foreign contacts, health histories and details about their personal relationships, including extramarital affairs.

Later that year, Chinese President Xi Jinping and US President Barack Obama announced that they had reached an understanding that their respective countries would refrain from conducting state-sponsored cyber attacks on each other while they negotiated international legal frameworks to regulate “appropriate conduct in cyberspace”. In practice, this agreement served as little more than an exercise in public relations to show superficial goodwill between the two countries.

The next major blow in this digital conflict was struck in 2017, when a cyber-intelligence wing of the Chinese military breached the servers of Equifax, one of the world’s largest consumer credit reporting agencies, and accessed the birthdates and social security numbers of over half of the American population.

This marked a distinct shift towards a new era in cyberwarfare and international relations; the Justice Department claimed that this information is valuable to the Chinese government, particularly its intelligence services, because it allows them to see if any known American government employees were struggling financially and would thus be susceptible to bribery.

In 2020, the Trump administration announced that it was considering banning TikTok, a popular video-sharing app, from the United States because of concerns that Beijing could easily access the personal information of American users through the app’s Chinese creator, ByteDance. It was recently revealed that ByteDance’s engineers in China could access US user data while their US-based counterparts could not.

Beyond its use in exploiting human vulnerabilities within a rival government, the mass collection of personal data can be used to tailor a country’s soft power and political interference campaigns; data about internet traffic is crucial to painting an accurate picture of a national zeitgeist, completely transforming the nature of intelligence-gathering.

For example, by identifying the content with which a specific group interacts, an actor can tailor its messaging to a target audience. In the past, aggregate data has been used to inflame tensions between groups and otherwise meddle in domestic politics, perhaps best exemplified by the Cambridge Analytica scandal and Russia’s interference in the 2016 American presidential election.

With nearly one billion users worldwide and ByteDance’s legal obligation to provide the Chinese government with user data, as well as its existing access to it, TikTok is a unique tool for the Chinese government to harvest the sensitive data of the app’s users. The app is banned in several countries, including India, whose government has cited privacy concerns as the reason for banning the app.

China’s stringent internet censorship makes it difficult for the United States to have an intelligence asset equivalent to TikTok but, from what can be gleaned from public information, it is still very active in its cyberespionage efforts. Chinese state media outlets have recently begun to publicise American cyberattacks in China and around the world, in an apparent effort to both position itself as a dominant figure in cyberspace and to drive a wedge between the United States and its allies, showing that no country is safe from American cyberespionage.

Amid this new era of great power competition, and as the New Cold War quickly heats up, both the United States and China will continue to exploit vulnerabilities in the other’s digital systems to grow their respective collections of personal data. Many of the world’s leading analysts and strategists note that the US-China rivalry is the dominant feature of contemporary geopolitics. As this competition intensifies, so too will the ongoing cyber warfare escalate.

Putin’s Bomb, the Global Shrapnel and the New World Order

Dear New Silk Road Fellow Travelers,

I wanted to share with you a piece I wrote more than a month ago on Russia’s invasion of Ukraine and its worldwide implications.

You can find the full article over at Emerging World, my Substack newsletter.

Here is an excerpt below:

Russian President Vladimir Putin’s brutal invasion of Ukraine set off a bomb in our global order. The question on all of our minds is: Where is all of this headed?

First and foremost, there is the tragic human toll in Ukraine. Bucha. Mariupol. Kyiv. Cities little known to most of the world have now become symbols of war crimes, tragedy, and courage.

Beyond this immediate human impact, there is the feel of tectonic plates crunching, of certainties crumbling, of history spinning a new web that will entangle us all.

That old, pithy quote from Lenin is back, making its way through Twitter and chat rooms: “sometimes decades pass, and nothing happens. Then, weeks pass, and decades happen.”

I remember seeing that quote trotted out during another seemingly historic moment – the Arab Uprisings of 2010-11. But this is obviously different. This feels 19th century – land grabs and diplomats huddling and soldiers marching through the cold. But, of course, this is the 21st century, so the tools of our era — from ballistic missiles to drones to social media to sanctions — are also shaping the outcome.

What to make of these “decades” happening over the past two weeks? Of Putin’s gamble? Of Putin himself? After all, this was a leader, the pundits told us, who may be brutal, but he was ‘savvy’ and ‘clever,’ the sort who may set a fire (ask the citizens of Aleppo of Putin’s fire), but not get singed. He is certainly feeling the heat now — even as his forces continue to rain fire on Ukraine.

How long can this last? Where will this end? Will the conflict metastasize? This leads to the ultimate question: are we on the verge of World War III? These are questions almost impossible to answer, so I will not, dear reader, abuse your attention with my idle speculation. Not only is there fog in war, but there is fog in the minds of key leaders who, ultimately, will drive this war.

For the full article, go here

The World’s Most Vaccinated Nations

By Zubin Eimen

The Covid-19 pandemic dramatically transformed our lives, leading to millions of deaths and reordering societies all around the world. From the masks we wore every day, to the virtual meetings and classes we attended, to the limited capacity and social distancing guidelines we followed, to the many loved ones we could not see in-person, the pandemic will forever be remembered as a defining moment in our history.

First detected in China in early January 2020 as a novel coronavirus, COVID-19 has infected more than 209 million people worldwide and caused some 4.4 million deaths. The United States, India, and Brazil have been the hardest hit nations in the world, both in terms of total cases and total deaths. When looking at deaths per capita, however, Peru is at the top of the list along with several European countries such as Hungary and the Czech Republic.

In December 2020, a glimmer of hope was brought onto the world as the United Kingdom became the first nation to officially approve a COVID-19 vaccine for widespread use with the Pfizer-BioNtech vaccine. The United States soon followed suit, rolling out the same vaccine, along with the Moderna and Johnson & Johnson vaccines shortly after. All three of these vaccines, as well as Oxford-AstraZeneca, have been approved and distributed throughout much of the world. Russia and China have developed, approved, and distributed their own vaccines as well.

Though the world still faces tremendous challenges, from post-Covid economic recoveries to the rise of variants that challenge vaccines and re-openings, in many parts of the world we are finally beginning to witness a re-emergence to some level of normalcy. As nations all across the world steadily increase their vaccination efforts, as well as administer more effective therapeutics, it is a good time to look at the progress we have made.

There are many hurdles that can go into trying to get people vaccinated within a specific region, including limited available resources, distribution inefficiency, and vaccine hesitancy. For example, although the United Kingdom and the United States were two of the first nations to approve COVID-19 vaccines, and have had profound distribution efforts, they are both not in the top ten of percentage of population vaccinated.

When looking at the percentage of the population vaccinated within continents, Europe and North America dominate this list. Many of the low-income countries in Asia, Africa, and South America have yet to make significant strides with the limited supplies currently available to them. The international community has pledged equitable access to COVID-19 vaccines will eventually be achieved, however, through the worldwide initiative called COVAX.

Here are the current Top Ten nations and Top Six continents by percentage of population fully vaccinated:

| Country | % Population Fully Vaccinated |

| 1. Iceland | 74.8 |

| 2. United Arab Emirates | 73.0 |

| 3. Singapore | 71.3 |

| 4. Uruguay | 69.3 |

| 5. Qatar | 66.3 |

| T-6. Belgium | 66.0 |

| T-6. Denmark | 66.0 |

| 8. Portugal | 64.8 |

| 9. Canada | 64.2 |

| 10. Spain | 63.7 |

*Excludes small islands, nations, and territories; U.S. #27 (50.4%)

| Continent | % Population Fully Vaccinated |

| 1. Europe | 44.04 |

| 2. North America | 39.95 |

| 3. Asia | 24.60 |

| 4. South America | 24.58 |

| 5. Oceania | 15.66 |

| 6. Africa | 2.20 |

Sources:

https://www.cnn.com/interactive/2021/health/global-covid-vaccinations/

https://ourworldindata.org/covid-vaccinations?country=

https://www.who.int/initiatives/act-accelerator/covax

Russia’s Top Ten Export Destinations

By Martin Vatanka

Like many countries, Russia faced economic contraction in 2020 as the Covid-19 pandemic wreaked havoc on the global economy. Russia’s economy contracted by 3% in 2020, though the country had been accustomed to slowing or negative growth long before the pandemic. Ever since its GDP hit an all-time high of $2.292 trillion in 2013, the economy has been on the decline or slowing, owing to volatile oil prices and mounting Western sanctions due to its annexation of Crimea.

For Russia’s economy to fulfill its potential, it will need to grow and diversify its export base. Here are the top ten export destinations for Russian goods

Russia’s Top Ten Export Destinations – 2020

- China $49.58 Billion

- The Netherlands $25.34 Billion

- United Kingdom $23.06 Billion

- Germany $18.63 Billion

- Belarus $16.02 Billion

- Turkey $15.75 Billon

- Kazakhstan $14.05 Billion

- South Korea $12.52 Billion

- United States of America $10.82 Billion

- Italy $9.87 Billion

Of note:

- China became the top 1 biggest customer of Russian exports in 2017, overtaking the Netherlands.

- Russia’s top exports to the international community are Crude Petroleum, Refined Petroleum, Gold, and Coal.

- Russia’s GDP hit an all time high of 2.292 trillion USD in 2013, shortly before the Russian annexation of the Crimea in March 2014, which led to many sanctions by the European Union and the United States being put on Russia and severely hurting its economic growth.